ontario ca sales tax calculator

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Ontario is in the following zip codes.

7 2 Property Taxes Mathematics Libretexts

Ad Lookup Sales Tax Rates For Free.

. Current 2022 HST rate in Ontario province is 13. Harmonized Sales Tax HST in Ontario What is the current 2022 HST rate in Ontario. This marginal tax rate means that your immediate additional income will be taxed at this rate.

175 lower than the maximum sales tax in CA The 775 sales tax rate in Ontario consists of 6 California state sales tax 025 San Bernardino County sales tax and 15 Special tax. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage.

New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island. For tax rates in other cities see California sales taxes by city and county. The County sales tax rate is.

This marginal tax rate means that your immediate additional income will be taxed at this rate. The minimum combined 2022 sales tax rate for Ontario California is. That means that your net pay will be 40568 per year or 3381 per month.

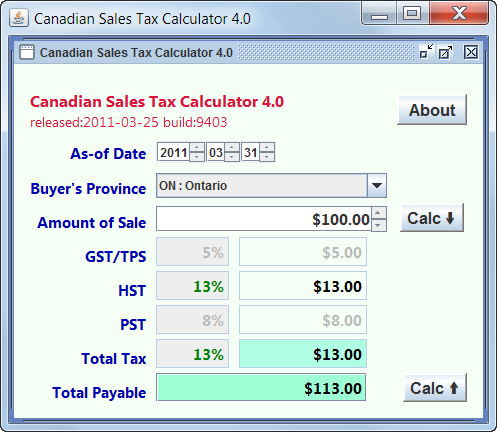

Ontario applies 13 HST to most purchases meaning a 13 total sales tax rate. Ensure that the Find Subtotal before tax tab is selected. Formula for calculating HST in Ontario Amount without sales tax x HST rate100 Amount of HST in Ontario Amount without sales tax HST amount Total amount with sales taxes Example 100 x 13100 13 100 13 113 HST changes.

Province of Sale Select the province where the product buyer is located. Call the CRA at 1-855-330-3305 to order a copy. It is essentially the General Sales Tax and a Provincial Sales Tax rolled into one.

Business professional commission partnership fishing and farming income. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services. 5 Federal part and 8 Provincial Part.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Ontario CA. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Ontario CA. There is no applicable city tax.

View and order forms at canadacataxes-general-package. Sales taxes in Ontario where changed in 2010 then instead of GST and PST was introduced Harmonized sales tax HST. Use our simple 2021 tax calculator to quickly estimate your federal and provincial taxes.

Your average tax rate is 220 and your marginal tax rate is 353. Did South Dakota v. The California sales tax rate is currently.

91758 91761 91762 91764 91798. Your average tax rate is 220 and your marginal tax rate is 353. ON479 allows you to claim the.

California has a 6 statewide sales tax rate but also has 475 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2618 on top. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. On July 1st 2010 HST Harmonized Sales.

100 13 HST 113 total. Interactive Tax Map Unlimited Use. Sales Tax Breakdown Ontario Details Ontario CA is in San Bernardino County.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The information deisplayed in the Ontario Tax Brackets for 2022 is used for the 2022 Ontario Tax Calculator 2022 Income Tax in Ontario is calculated separately for Federal tax commitments and Ontario Province Tax commitments depending on where the individual tax return is filed in 2022 due to work location. Ontario Political Contribution Tax Credit.

That means that your net pay will be 40568 per year or 3381 per month. Calculating sales tax in Ontario is easy. The HST for Ontario is calculated from Ontario rate 8 and Canada rate 5 for a total of 13.

Income Tax Calculator Ontario 2021. Wayfair Inc affect California. 14 rows GSTHST calculator Use this calculator to find out the amount of tax.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Look up the current sales and use tax rate by address. To calculate the subtotal amount and sales taxes from a total.

To access tax credits and benefits when filing a paper tax return complete and submit these three forms with your tax return. HST stands for Harmonized Sales Tax. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

2021 Income Tax Calculator Ontario. Eligibility for the 2022 benefit year July 2022 June 2023 To qualify you must be a resident of Ontario on December 31 2021 and at least one. Ontario CA Sales Tax Rate The current total local sales tax rate in Ontario CA is 7750.

This is the total of state county and city sales tax rates. The total amount of your capital gains. California City County Sales Use Tax Rates effective January 1 2022 These rates may be outdated.

It ranges from 13 in Ontario to 15 in other provinces and is composed of a provincial tax and a. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. This credit is a tax-free payment to help you with your property taxes and sales tax on energy costs.

The Ontario sales tax rate is. You can print a 775 sales tax table here. Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces.

Sales tax in Ontario Here is an example of how Ontario applies sales tax. History of sales taxes in Ontario. In general these are dividends received from public companies.

Press Calculate and youll see the tax amounts as well as the grand total subtotal taxes appear in the fields below. Employment income and taxable benefits. The December 2020 total local sales tax rate was also 7750.

How To Calculate Sales Tax In Excel

7 1 Sales Taxes Mathematics Libretexts

What Is The Income Tax Rate In Ontario Quora

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel

Paycheck Calculator Take Home Pay Calculator

Canadian Gst Hst Pst Tps Tvq Qst Sales Tax Calculator

Canada Sales Tax Gst Hst Calculator Wowa Ca

Ontario Income Tax Calculator Calculatorscanada Ca

Gst Calculator Goods And Services Tax Calculation

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

Income Tax Calculator Calculatorscanada Ca

How To Calculate Sales Tax In Excel Tutorial Youtube